Personal Finance Planner Spreadsheet

We have moved Personal Finance Planner to its new home.

If you are not being redirect in 5 seconds, click here...

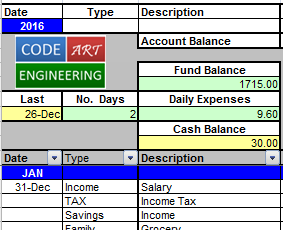

Personal Finance Planner is a tool designed to track monthly expenses and build savings plan. The tool is designed to manage multiple debit accounts (savings / current accounts) and credit accounts (credit cards) while keeping funds allocated for monthly expenses and savings separated. There is also a analysis tool which helps to analyze monthly expenses.

If you are not being redirect in 5 seconds, click here...

Introduction

Personal Finance Planner is a tool designed to track monthly expenses and build savings plan. The tool is designed to manage multiple debit accounts (savings / current accounts) and credit accounts (credit cards) while keeping funds allocated for monthly expenses and savings separated. There is also a analysis tool which helps to analyze monthly expenses.

The tool is designed with the following rules:

- Balance at month end should be 0. Remaining funds for each month are deposit into savings.

- Income and money received is recorded as positive value.

- Expenses is recorded as negative value.

- Savings fund is managed separately from monthly expenses.

- Fund is reserved to pay every single cent spent on credit card by month end.

- Each expenses is tracked on net value spent / received.

- No overdraft. Overspend amount is deducted from savings.